Author: Ulink Media

5G was once wildly pursued by the industry, and all walks of life had super-high expectations for it. Nowadays, 5G has gradually entered a period of stable development, and everyone's attitude has returned to "calm". Despite the decreasing volume of voices in the industry and the mix of positive and negative news about 5G, AIoT Research Institute still pays attention to the latest development of 5G, and has formed a "Cellular IoT Series of 5G Market Tracking and Research Report (2023 Edition)" for this purpose. Here, some of the contents of the report will be extracted to show the real development of 5G eMBB, 5G RedCap and 5G NB-IoT with objective data.

5G eMBB

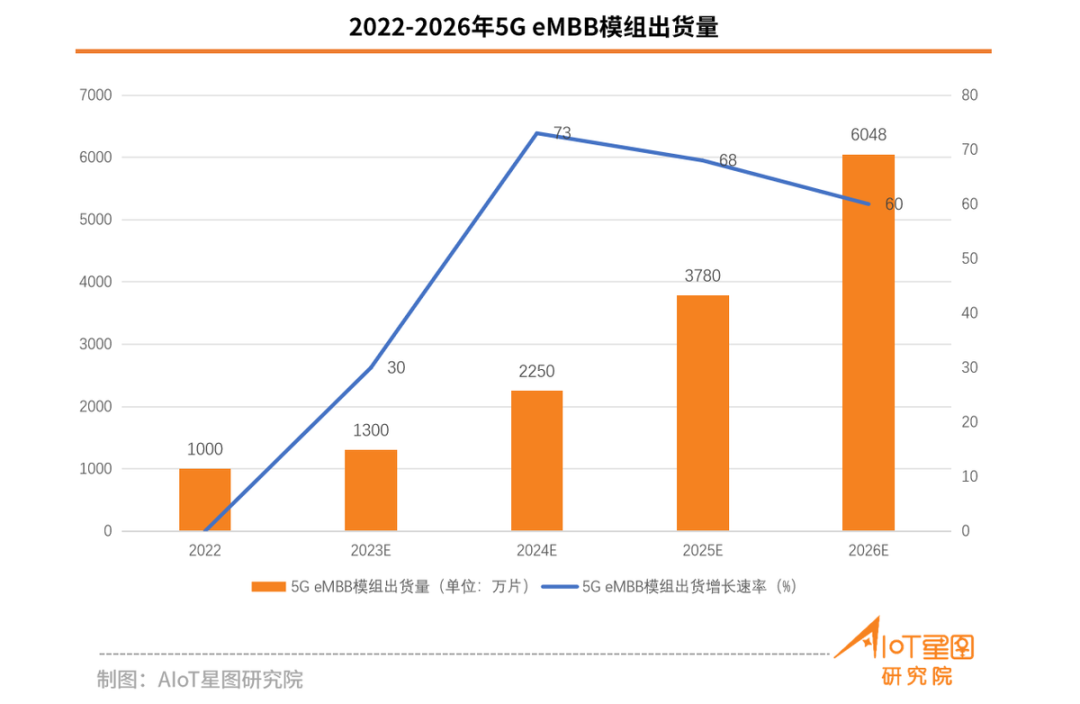

From the perspective of 5G eMBB terminal module shipments, at present, in the non-cellular market, the shipments of 5G eMBB modules are relatively small compared with expectations. Taking the total shipment of 5G eMBB modules in 2022 as an example, the shipment volume is 10 million globally, of which 20%-30% of the shipment volume comes from the Chinese market. 2023 will see growth, and the total global shipment volume of 5G eMBB modules is expected to reach 1,300w. After 2023, due to the more mature technology and fuller exploration of the application market, coupled with the small base in the previous period, it may maintain a higher growth rate. , or will maintain a higher growth rate. According to the forecast of AIoT StarMap Research Institute, the growth rate will reach 60%-75% in the next few years.

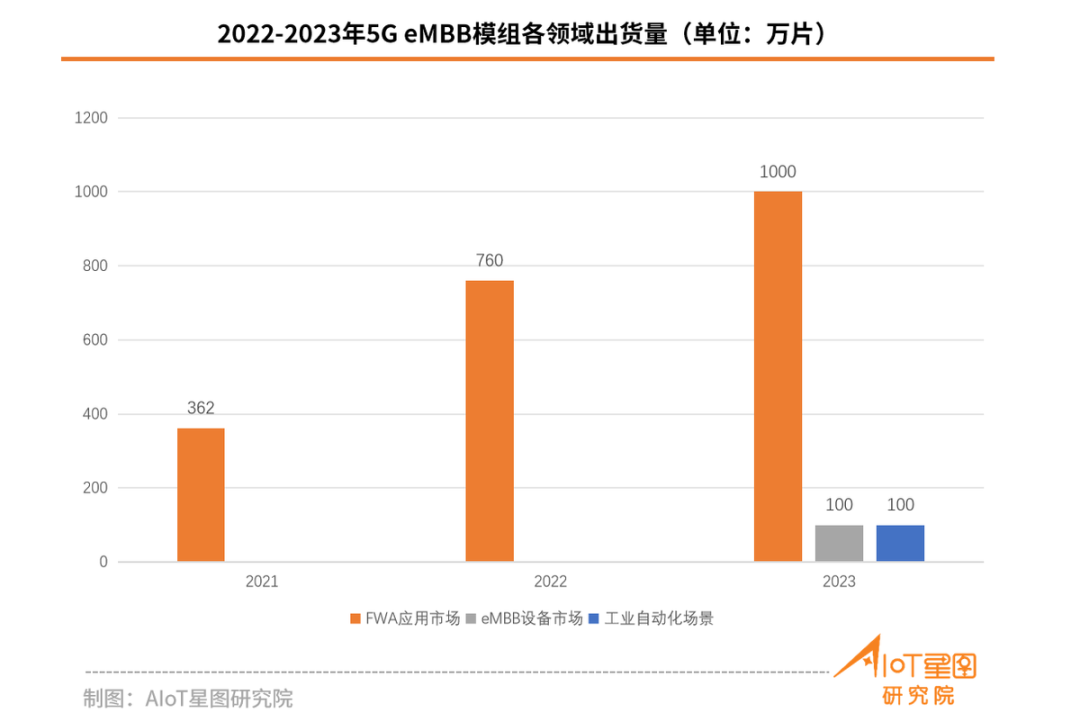

From the perspective of 5G eMBB terminal module shipments, for the global market, the largest share of IoT application shipments is in the FWA application market, which includes a variety of terminal forms such as CPE, MiFi, IDU/ODU, etc., followed by the eMBB equipment market, where the terminal forms are mainly VR/XR, vehicle-mounted terminals, etc., and then the industrial automation market, where the main terminal forms are industrial gateway, work card, etc. Then there is the industrial automation market, where the main terminal forms are industrial gateways and industrial cards. The most typical terminal is CPE, with a shipment volume of about 6 million pieces in 2022, and the shipment volume is expected to reach 8 million pieces in 2023.

For the domestic market, the main shipping area of 5G terminal module is the automotive market, and only a few car makers (such as BYD) are using 5G eMBB module, of course, there are other car makers are testing with module manufacturers. It is expected that the domestic shipment will reach 1 million pieces in 2023.

5G RedCap

Since the freezing of the R17 version of the standard, the industry has been promoting the commercialisation of 5G RedCap based on the standard. Today, the commercialisation of 5G RedCap seems to be progressing faster than expected.

In the first half of 2023, 5G RedCap technology and products will gradually mature. So far, some vendors have launched their first-generation 5G RedCap products for testing, and it is expected that in the first half of 2024, more 5G RedCap chips, modules and terminals will enter the market, which will open up some scenarios for application, and in 2025, large-scale application will begin to be realised.

At present, chip makers, module makers, operators and terminal enterprises have made efforts to gradually promote 5G RedCap end-to-end testing, technology verification and product and solution development.

Regarding the cost of 5G RedCap modules, there is still a certain gap between the initial cost of 5G RedCap and Cat.4. Although 5G RedCap can save 50%-60% of the cost of existing 5G eMBB modules by reducing the use of many devices through tailoring, it will still cost more than $100 or even about $200. However, with the development of the industry, the cost of 5G RedCap modules will continue to drop until it is comparable to the current mainstream Cat.4 module cost of $50-80.

5G NB-IoT

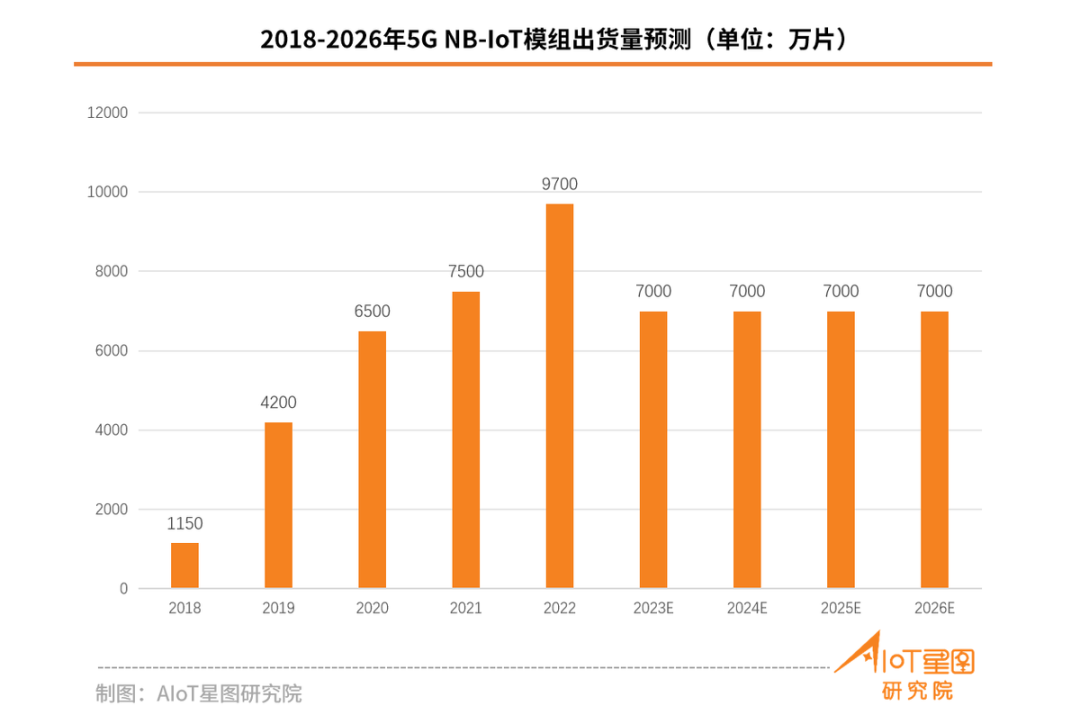

After the high-profile publicity and high-speed development of 5G NB-IoT in the early stage, the development of 5G NB-IoT in the next few years has maintained a relatively stable state, no matter from the perspective of module shipment volume or shipment field. In terms of shipment volume, 5G NB-IoT stays above and below the 10 million level, as shown in the following figure.

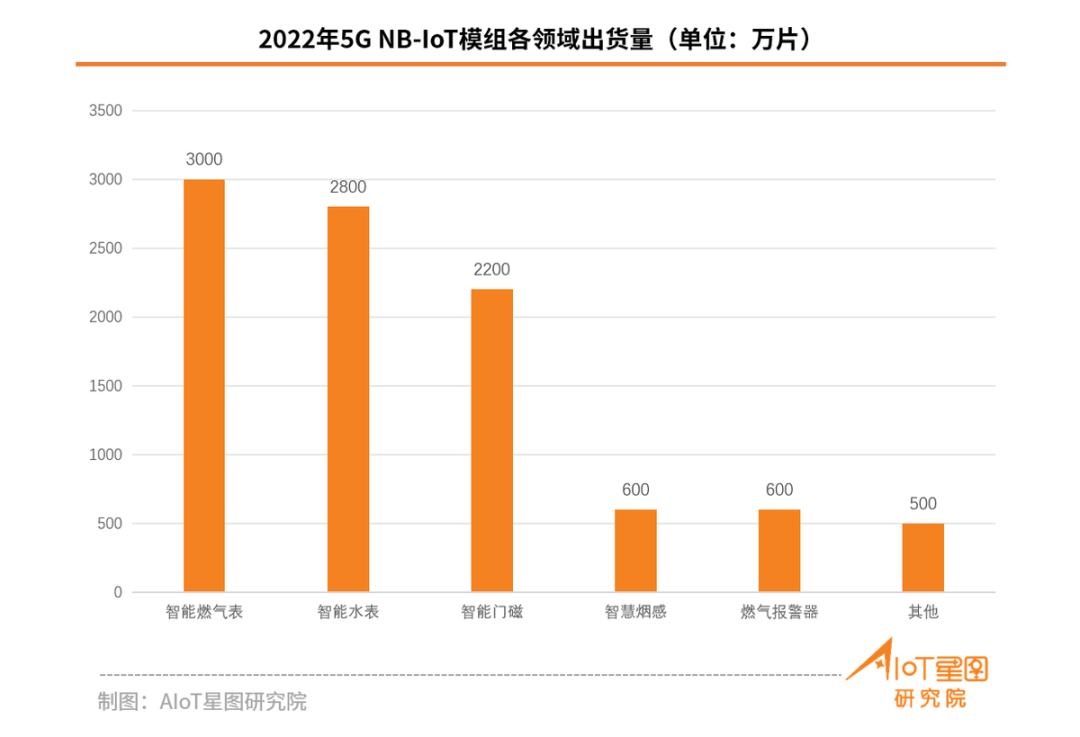

In terms of shipment areas, 5G NB-IoT has not stirred up a splash in more application areas, and its application areas are still mainly focused on several areas such as smart meters, smart door magnets, smart smoke sensors, gas alarms, etc. In 2022, the major shipments of 5G NB-IoT will be as follows:

Promoting the development of 5G terminals from multiple angles and Continuously enrich the number and type of terminals

Since the commercialisation of 5G, the government has actively encouraged 5G industry chain enterprises to accelerate the pilot exploration of 5G industry application scenarios, and 5G has shown a "multi-point blossoming" state in the industry application market, with varying degrees of landings in the industrial Internet, autonomous driving, telemedicine and other niche areas. After nearly a few years of exploration, 5G industry applications are becoming clearer and clearer, from the pilot exploration into the rapid promotion stage, with the spread of industry applications. At present, the industry is actively promoting the development of 5G industry terminals from multiple angles.

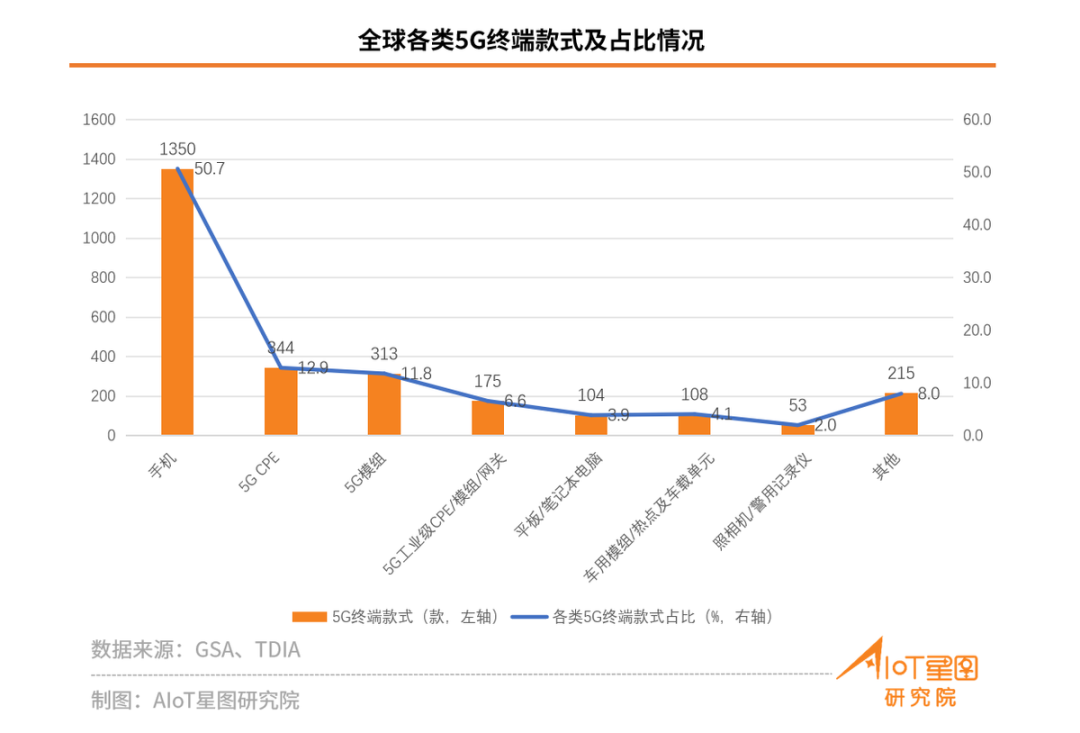

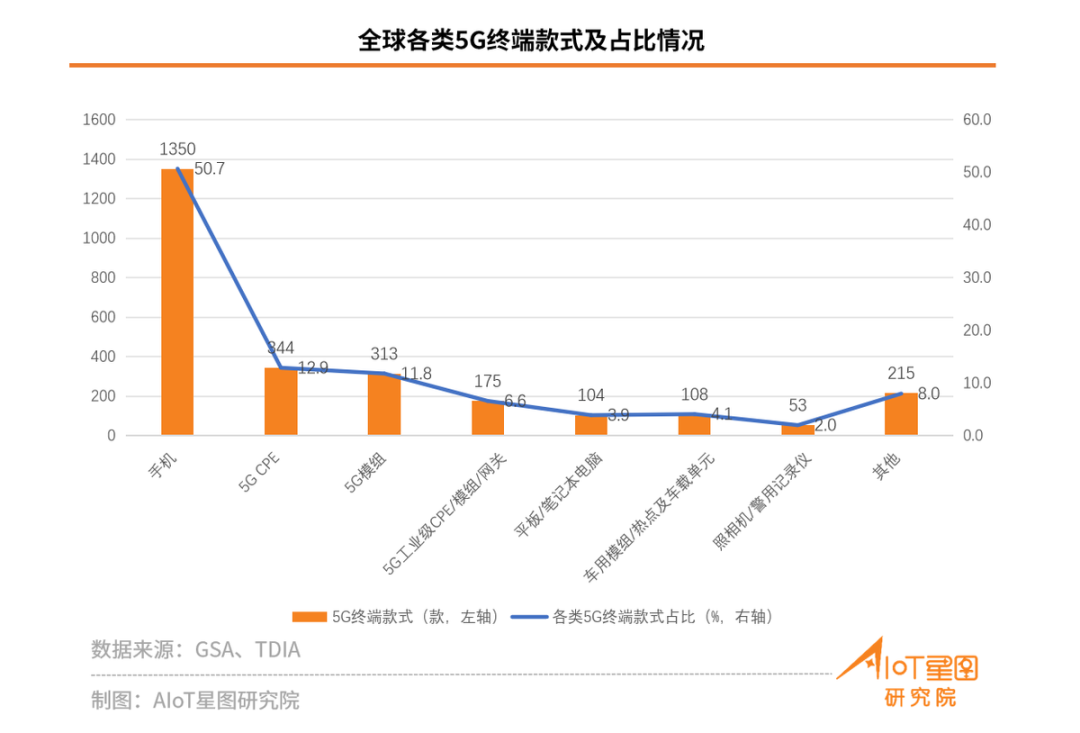

From the perspective of industry terminals alone, as the commercialisation of 5G industry terminals is gradually accelerating, domestic and foreign terminal equipment manufacturers are ready to go, and they continue to increase R&D investment in 5G industry terminals, so the number and types of 5G industry terminals continue to be enriched. As for the global 5G terminal market, as of Q2 2023, 448 terminal vendors around the world have released 2,662 models of 5G terminals (including available and upcoming), and there are nearly 30 types of terminal forms, of which non-handset 5G terminals account for 50.7%. In addition to mobile phones, the ecosystem of 5G CPEs, 5G modules and industrial gateways is maturing, and the proportion of each type of 5G terminal is as above.

As for the domestic 5G terminal market, as of Q2 2023, a total of 1,274 models of 5G terminals from 278 terminal vendors in China have obtained network access permits from the MIIT.The outreach of 5G terminals has continued to expand, with mobile phones accounting for more than half of the total at about 62.8%. In addition to mobile phones, the ecosystem of 5G modules, vehicle-mounted terminals, 5G CPEs, law enforcement recorders, tablet PCs and industrial gateways is maturing, and the scale is generally small, presenting the characteristics of many types but very small application scale. The proportion of various types of 5G terminal types in China is as follows:

In addition, according to the forecast of China Academy of Information and Communications Technology (AICT), by 2025, the cumulative total of 5G terminals will be more than 3,200, of which the cumulative total of industry terminals can be 2,000, with the simultaneous development of "basic + customised", and ten million connections can be realised. In the era of "everything is connected", in which 5G is constantly deepening, the Internet of Things (IoT), including terminals, has a market space of more than 10 trillion US dollars, and the potential market space of intelligent terminal equipment, including various types of industrial terminals, is as high as 2~3 trillion US dollars.

Post time: Nov-16-2023