Recently, WeChat officially released the palm swipe payment function and terminal. At present, WeChat Pay has joined hands with Beijing Metro Daxing Airport Line to launch the "palm swipe" service at Caoqiao Station, Daxing New Town Station and Daxing Airport Station. There is also news that Alipay is also planning to launch a palm payment function.

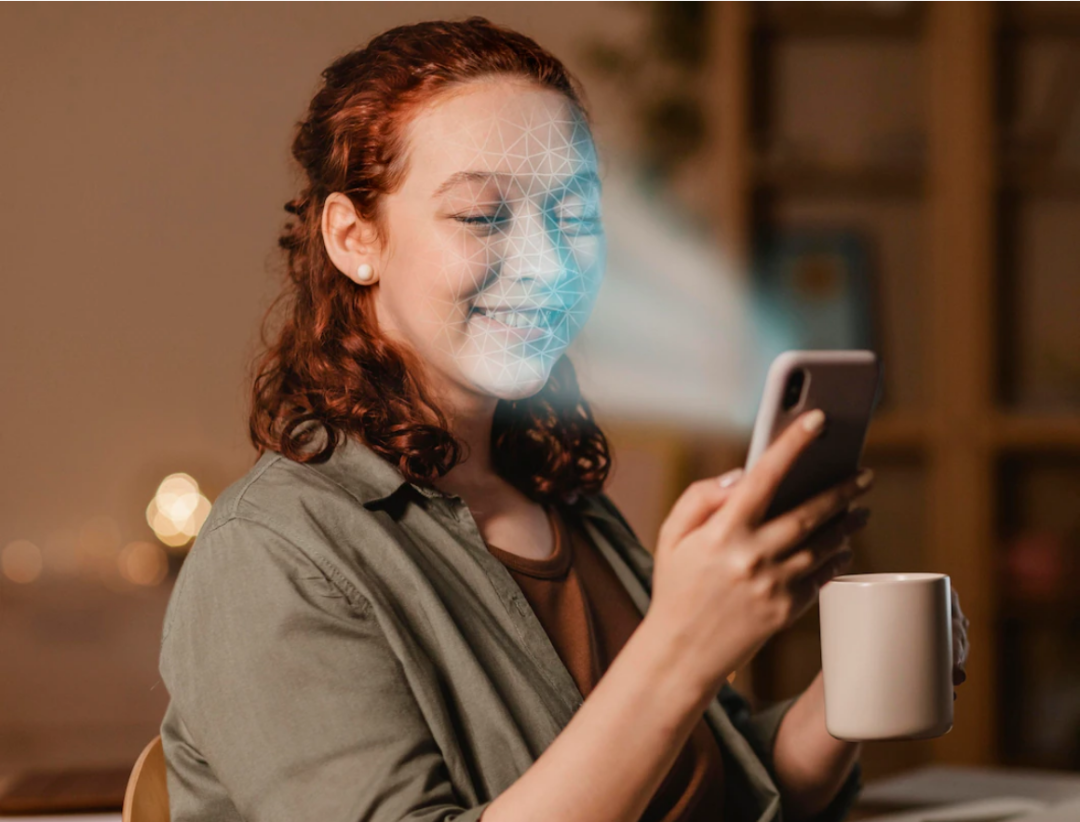

The palm swipe payment has created a lot of buzz as one of the biometric payment technologies, why has it generated so much attention and discussion? Will it just blow up like face payment? How is biometric payment going to break through to the large volume of QR code payments currently occupying the market?

Biometric payments, striving for layout

After the news of palm swipe payment was made public, entropy-based technology, Han Wang Technology, Yuanfang Information, Baxxon Intelligence and other related concept stocks have surged higher. Once again, palm payment pushed biometric technology to the forefront of everyone's mind.

In September 2014, Alipay wallet and Huawei jointly launched the first standard scheme of fingerprint payment in China, and then fingerprint payment once became the most widely used technology in biometrics, and fingerprint unlocking also entered the smart home field and became an important part of intelligence. Fingerprint recognition is to read the epidermal pattern of the finger, while the palm payment uses the "palm print + palm vein" identification system, which is difficult to replicate and forge, and is a media-free, non-contact, highly portable and highly secure payment method.

Another biometric technology that has been promoted in the payment field is face recognition. 2014, Jack Ma first demonstrated face payment technology, and then in 2017, Alipay announced the launch of face payment in KFC's KPRO restaurant and went commercial. "Dragonfly". WeChat followed suit, and in 2017 WeChat Pay's first national face wisdom fashion shop landed in Shenzhen; and then in 2019 WeChat Pay also joined with Huajie Amy to launch the face payment device "Frog". 2017 iPhone X introduced 3D face recognition technology to the payment field and also quickly moved industry trends ......

In the nearly five years since the introduction of face swipe, the major giants have been competing particularly fiercely in the face swipe payment market, even going so far as to grab the market with heavy subsidies. Alipay had an incentive mechanism of 0.7 yuan continuous rebate for 6 months for each face swipe user for merchants who use large screen face swipe self-service devices.

At this stage, supermarkets and convenience stores are the places where face payment is more applied, but a market survey found that a small number of people would use face payment, and generally customers do not actively ask to use it, and the coverage rate of Alipay face payment is higher than that of WeChat payment.

Back then it took four to five years for people to accept recognition from cash to sweeping codes, but face swipe payment was hindered in its advancement due to privacy leaks, algorithms, forgery and other reasons. Compared to the payment field, face recognition is instead more widely used in identity verification.

From a technical point of view, palm swipe payment will be more secure and accurate than face swipe payment, and by using data desensitization and data encryption technology, it can effectively ensure the safe use of users. From the B-side, the "palm print + palm vein" two-factor verification mode of palm payment can tighten the risk control line of merchants, such as catering, retail and other industries, palm payment can greatly improve payment efficiency and reduce payment time and labor costs; from the C-side, palm payment can also improve user experience, main performance such as no electricity payment, no From the C-side, palm payment can also enhance the user experience, mainly in the form of electricity-free payment and contactless payment.

The payments market landscape has emerged

There are two main types of mobile payment methods used by people today, one is online payment, like Taobao, Jingdong online shopping payment, Alipay WeChat friend transfer, etc.; another is payment through smartphone terminals, such as the most common is to sweep two-dimensional code payment.

In fact, early mobile payment is mainly realized through NFC, in 2004, Philips, Sony, Nokia jointly launched the NFC Forum, began to promote the commercial application of NFC technology. 2005, just three years after the establishment of China UnionPay set up a special project team, responsible for tracking and researching the development of NFC; in 2006, China UnionPay launched a financial IC card chip-based In 2006, China UnionPay launched a mobile payment solution based on the financial IC card chip; in 2009, China Unicom launched a customised card swipe mobile phone with a built-in NFC chip.

Conclusion

However, due to the rise of 3G and the fact that POS terminals were not popular at the time, NFC payments did not set off a frenzy in the market. In 2016, Apple Pay adopted NFC payments in the number of bank cards bound within 12 hours of its launch exceeded 38 million, which greatly promoted the development of NFC payments. Development to date, NFC precipitated in specific scenarios of electronic payments (such as digital RMB touch payment), city traffic cards, access control, and eID (electronic identification of citizens network) in these areas.

The rapid sweep of Alipay and WeChat sweep payments around 2014 made it difficult for Samsung Pay, launched by Samsung in 2016, Xiaomi's Mi Pay and Huawei's Huawei Pay to enter the Chinese mobile payment market. In the same year, Alipay launched QR code collection, further increasing the advantages of swipe payments in conjunction with the emergence of bicycle sharing.

With more and more retailers joining, sweep code payment gradually solidified its position in the payment market. According to data, QR code payment remains the mainstream payment method for mobile payments in 2022, with its share reaching 95.8%. In Q4 2022 alone, the transaction scale of China's offline code-sweeping market was RMB 12.58 trillion.

QR code payment is completed by the user presenting a QR code, based on image recognition technology. As the application spreads, market demand also begins to increase, and a host of related products such as cash registers, smart machines, and handhelds are introduced one after another. With the large volume application of sweep code payment, the usage rate of sweep code cash registers is also high, and their terminal types include cash registers, sweep code payment boxes, smart cash registers, face payment terminals, handheld all-in-one machines, cash register audio, etc. Among them, the relevant terminal products of New World, Honeywell, Shangmee, Sunray, Comet, and Cash Register Bar have been spread out in the payment market coverage.

Post time: May-24-2023